Description

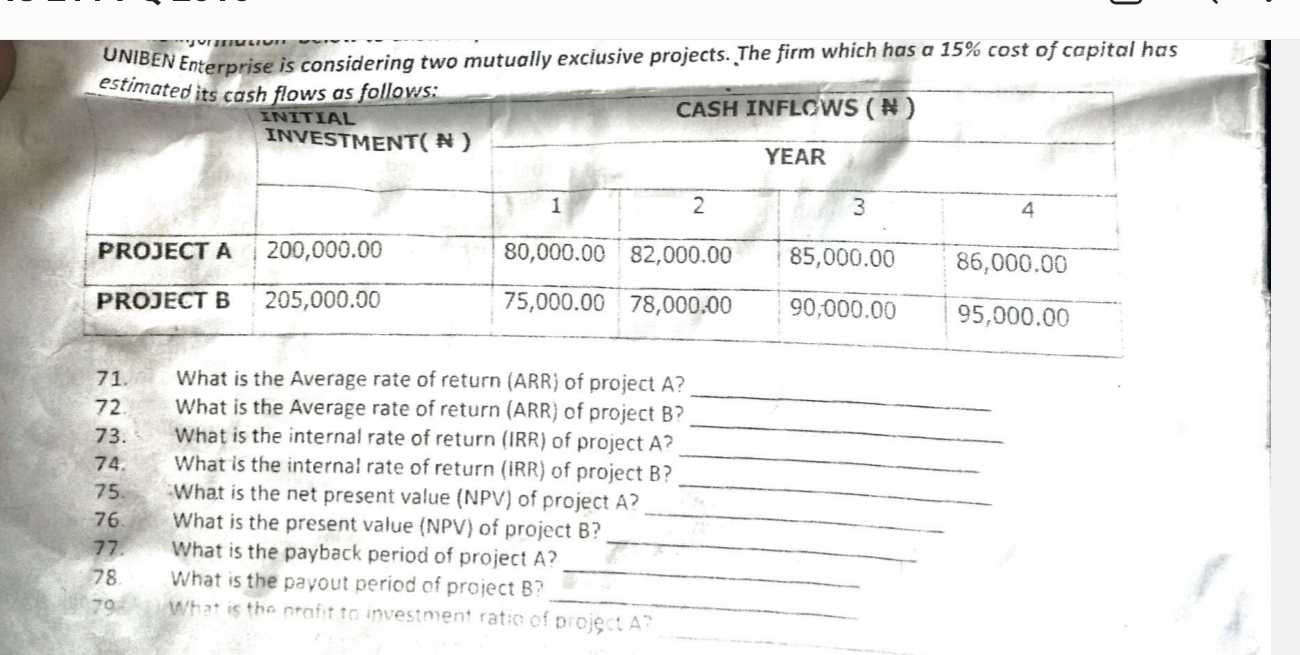

UNIBEN Enterprise is considering two mutually exciusive projects. The firm which has a 15% cost of capital has estimated its cash flows as follows:

71. What is the Average rate of return (ARR) of project A ? q,

72. What is the Average rate of return (ARR) of project B ? q,

73. What is the internal rate of return (IRR) of project A ? q,

74. What is the internal rate of return (IRR) of project B?

75. What is the net present value (NPV) of project A ? q,

76. What is the present value (NPV) of project B? q,

77. What is the payback period of project A ? q,

78. What is the payout period of project B ? q,

79 What is the nrofit to investment ratio of project A ? q,

Reviews

There are no reviews yet.